Weekly FX Technical Analysis - 9th February 2026

- jusdenhalabi

- 13 minutes ago

- 3 min read

FX markets remain finely balanced as several major pairs consolidate near key technical levels. This week’s charts highlight cooling momentum in GBP/USD and EUR/USD following recent rejections, continued range-bound trade in EUR/GBP, and elevated volatility in USD/JPY as markets assess the sustainability of recent moves. With trend structures largely intact but momentum softening, upcoming data and central bank expectations will be critical in shaping the next directional break.

GBP/USD

GBP/USD has pulled back from recent highs near the 1.38 region after failing to sustain a break above longer-term descending trendline resistance. Price is now consolidating in the mid-1.35s, with former resistance around 1.35 acting as near-term support. Despite the recent rejection, the broader structure remains constructive, with the pair holding above its rising medium-term trendline. RSI has eased back toward neutral territory, suggesting momentum has cooled but not reversed.

Potential Scenarios

Bullish: A sustained move back above 1.3700 would signal renewed upside momentum and reopen the path toward 1.3850.

Bearish: A break below 1.3450 would increase the risk of a deeper pullback toward 1.3300 support.

Macro Backdrop to Consider

Sterling remains sensitive to shifting expectations around Bank of England policy and broader US dollar dynamics. With markets reassessing the timing and scale of Fed easing in 2026, near-term GBP/USD direction is likely to be driven by relative yield expectations and global risk sentiment.

GBP/USD: FEBRUARY ‘25 - PRESENT

EUR/GBP

EUR/GBP continues to trade within a well-defined range, rebounding modestly toward the 0.8720 area after finding support near 0.8650. The pair remains capped below the 0.8750 resistance zone, which has repeatedly limited upside attempts in recent months. Trend structure is neutral to slightly constructive, but momentum remains muted, with RSI holding close to the mid-50 level.

Potential Scenarios

Bullish: A clean break above 0.8750 would shift the technical bias higher and target a move toward 0.8850.

Bearish: Failure to hold above 0.8650 would expose downside toward 0.8500 support.

Macro Backdrop to Consider

Relative central bank expectations remain the key driver for EUR/GBP. Any divergence between ECB and BoE policy outlooks could prompt a range breakout, but for now the cross remains anchored within familiar levels.

EUR/GBP: FEBRUARY ‘25 - PRESENT

EUR/USD

EUR/USD has retreated from recent highs just above 1.20 after failing to sustain a break above long-term resistance. The pair is currently consolidating around the 1.18 area, holding above its rising trend support. While the broader uptrend remains intact, momentum has softened following the rejection, with RSI drifting back toward neutral levels.

Potential Scenarios

Bullish: A renewed push above 1.2000 would reinforce the broader uptrend and open scope toward 1.2150.

Bearish: A break below 1.1700 would signal a deeper corrective move toward 1.1550 support.

Macro Backdrop to Consider

EUR/USD remains closely tied to relative growth and inflation expectations between the Eurozone and the US. Any repricing of Fed rate expectations or shifts in risk appetite could dictate near-term direction.

EUR/USD: FEBRUARY ‘25 - PRESENT

USD/JPY

USD/JPY has pulled back sharply from recent highs near the 160 level but remains elevated, consolidating in the mid-150s. Despite the correction, the broader bullish structure is still intact, with price holding above rising trend support. RSI has recovered from oversold conditions, suggesting selling pressure has eased for now.

Potential Scenarios

Bullish: A sustained recovery above 158.50 would bring the 160.00 resistance area back into focus.

Bearish: A break below 154.50 would increase downside risk toward 150.00 support.

Macro Backdrop to Consider

USD/JPY continues to be driven by yield differentials and expectations of ongoing policy divergence between the Fed and the Bank of Japan. Intervention risks remain elevated at higher levels, adding volatility to near-term price action.

USD/JPY: FEBRUARY ‘25 - PRESENT

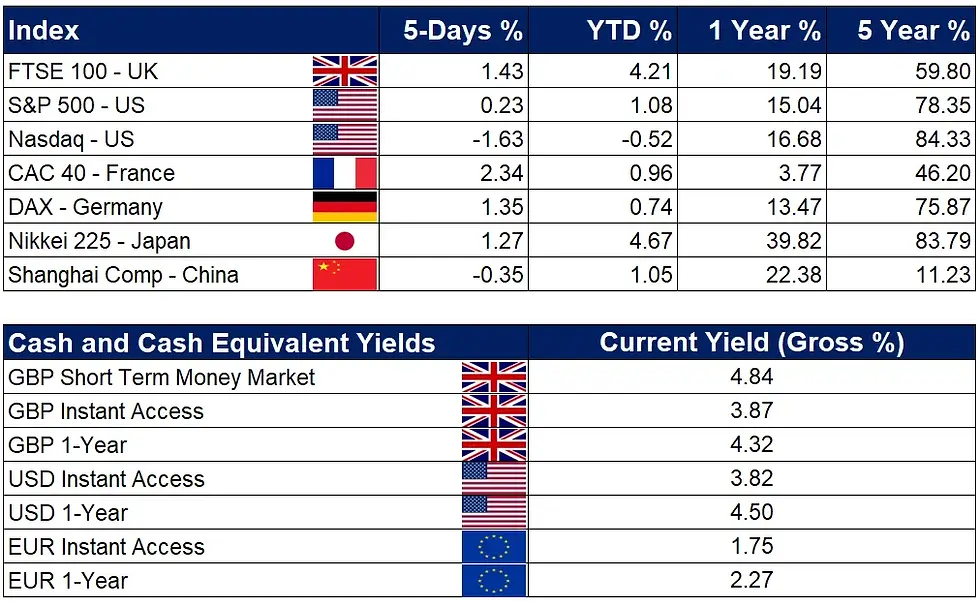

Current Cash Account Yields Available

As always, if you’d like to discuss these moves in more detail, or how they could impact your business or personal requirements, please don’t hesitate to get in touch.

+44 203 355 4603

Disclaimer: The information in this publication is provided for general information purposes only. It does not constitute financial or investment advice, nor should it be relied upon as such. Readers should consider their own circumstances and seek independent advice where appropriate.

.png)

Comments